When I entered the Wall Street scene as a municipal bond broker in May of 1984, most bonds were at stratospheric levels – securing seven-day settlements and 1% yield increases on a single trade date. In late October of that year, however, 30-year treasury bond yields fell to 11.6%, and the average muni rate for 1984 was approximately 10%1.

For the next six months, I encountered a standard rejection from seasoned muni bond investors: “I’m waiting for rates to go back up.” This anchoring bias for investors was born from the roller coaster highs of 14.36% yields (October 1981) down to 10.40% (April 1983) and back up to 13.08% (April 1984)2. However, the double-digit percentages of a golden era for muni bonds are in the rearview mirror. Wishing will not bring them back, but we likely wouldn’t wish for the economic uncertainty that accompanied those rates anyway. After all, we have uncertainty in abundance today.

Recent Muni Bond Movement

On March 5, 2020 – amidst a global health pandemic and rapid economic shutdown – we saw muni bond yields exceed the treasury yield for the first time since 20163. At the same time, we saw tax bases dry up overnight and governments scramble to find additional ways to cover their obligations. The uncertainty around current and future issues makes it important to consider potential default rates for muni bonds as states are charged with weathering (and finding funding for) the effects of COVID-194. Historically, municipal bonds’ default rate has been lower than those of corporate bonds – although that’s not always the case5. Comparatively, the U.S. Treasury has not defaulted on its note or bond obligations to date.

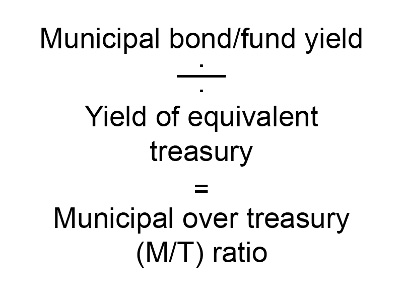

It’s not all bad news for the municipal bond markets with current rates still surpassing those of equivalent maturity treasuries based on the municipal over treasury (M/T) ratio – a general rule of thumb for deciding whether to buy municipal versus taxable bonds. M/T ratio is calculated by dividing the yield of a municipal bond or fund by the yield of an equivalent treasury. If the number is greater than .8, you might be better off with municipal bonds. If not, treasuries might be the way to go. As of June 19, 2020, the M/T ratio was 1.092 – meaning you could expect higher income from AAA muni bonds than from treasuries6.

Although fears still linger about continued economic slowdown, the Federal Reserve gave a huge boost to the security and liquidity of the municipal bond markets by agreeing to buy back up to $500 billion of muni bonds from qualifying cities and counties and expand purchases to include those with maturities inside of one year4. Without a definitive date for economic improvement, municipal budgets will continue to face challenges and the price of investments – including municipal bonds – will remain uncertain.

Historical Trends

When faced with uncharted economic waters, it can be helpful to study how muni bonds fared in the past, such as during the Great Depression. From 1929 to 1937, only 2.7% of all muni bond issuers defaulted on approximately $2.8 billion in debt. Research suggests that defaults in muni bonds lagged economic failures and mostly in the later years of the Great Depression.

During the technology bubble burst of the early 2000s, rating agencies didn’t downgrade credits despite months of recession and consequences that were obvious to many others. It’s important to do your homework on muni bonds and remember that – even in seemingly ‘safe’ sectors – higher credits can still default if political resilience and will-to-pay do not follow through7.

What Bonds to Buy

Every investor’s risk tolerance and end goal is different, so there’s no one-right answer for bond selection. However, it’s important to choose quality bonds – trusting the ratings but also minimizing duration to minimize interest rate risk. Bonds can be volatile – just like equities – so it’s critical they be considered as part of a broad, diversified portfolio and a financial plan designed around your unique situation and long-term goals. There are other options to help mitigate investment risk from municipal ETFs, Target Maturity Funds, actively managed mutual funds or separate account managers. However, whether you’re making a professional recommendation to clients or an individual investor selecting options, doing your research is key.

Wayne Anderman CFP® MBA is the founder of Anderman Wealth Partners, based in the Greater Fort Lauderdale Area, and a registered representative of Avantax Investment ServicesSM. Member FINRA, SIPC.

1 http://www.munibondadvisor.com/market.htm

2 https://www.macrotrends.net/2521/30-year-treasury-bond-rate-yield-chart

5 https://www.fidelity.com/learning-center/trading-investing/municipal-bond-market