Green muni bonds are becoming increasingly popular due to the rise of environmentally conscious investors. These investors are taking a stand by choosing to invest in projects that benefit the environment. Green muni bonds carry many of the basic risks of other municipal bonds, including interest rate risk and credit risk, but there are unique risks related to the environmental aspect of green bonds that investors should be aware of.

This article provides an overview of the green muni market and examines some of the additional risks to consider when investing in green muni bonds.

The Green Muni Market

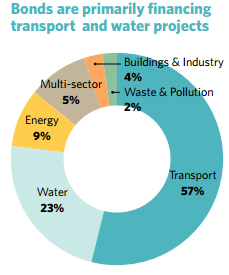

Muni bonds designated as green bonds receive a label that indicates the proceeds of the bond issue will be used on environmentally friendly projects. The majority of these designated green bonds pertain to projects involving water systems, transportation, power generation and land conservation.

According to the Climate Bonds Initiative 2016 report, labeled green muni issuance rose 47% in 2015 from the prior year to $4.7 billion. $923 million of that issuance came from one offering by the Seattle Transit Authority that remains one of the largest green muni issues to date.

Green muni bonds create an opportunity for like-minded borrowers and investors to unite for the common goal of improving the environment. The municipality issuing green bonds receives the political benefits associated with marketing their new project as environmentally friendly. Likewise, investors choose green muni bonds based on their socially responsible investment philosophy.

Be sure to check recent muni bond trades, including those of green munis.

Not sure why you should invest in green munis? Check out this article to learn more about them.

Unique Risks of Green Muni Bonds

Most investors choose green muni bonds for the social and environmental reasons – not because they expect to receive a higher yield than other muni bonds.

Green muni bonds are subject to the many of the same risks as non-green municipal bonds. As a result, proper due diligence should be completed to determine if the underlying credit of the municipality is a good investment.

There are additional risks investors choosing green bonds should consider. Here are some of them:

1. Greenwashing occurs when a project is marketed as environmentally friendly but turns out to be less beneficial than investors are led to believe. Since there is no formal regulatory agency granting the right to use the green label, third-party groups have emerged to help investors find bonds that have been certified green. The Climate Bonds Initiative, for example, provides a screening tool for certified climate bonds.

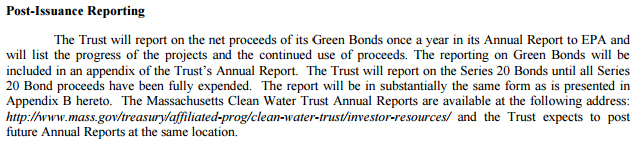

2. Non-disclosure risk results from a municipality issuing bonds labeled green but using the proceeds of the bonds for non-green projects. Municipalities address these concerns through post-issuance reporting on the use of funds. Non-disclosure risk can be mitigated by ensuring the funds are used on the projects they were intended for.

For instance, the Massachusetts State Clean Water Trust recently issued a series of green bonds and explained in the official statement their process of post-issuance reporting in the paragraph below.

Learn more about the Massachusetts State Clean Water Trust series here.

3. Second opinion risk occurs when an issuer pays a consultant to provide an opinion on the environmental benefits of a project. Since the consultant was paid, their opinion could be biased and could issue a favorable report on behalf of the issuer.

4. Regulatory risk is the potential for government regulations to prevent a municipality from labeling their bonds green. Since green bonds are becoming more popular, regulators could begin to scrutinize municipalities more heavily and the rules for the green label could become more strict. While this has not occurred yet in the U.S. muni market, the People’s Bank of China Green Finance Committee published a catalogue that created rules to define projects that are eligible for the green label.

Even investors who buy green muni bonds not strictly for environmental reasons are exposed to these risks. If environmentally conscious green muni investors discovered greenwashing or non-disclosure by a municipality, this could lead them to sell the bonds because the municipality did not meet their requirement as a green investment. While these risks may be less impactful than duration or credit risk, they should still be taken into account.

The Bottom Line

Green muni bonds are becoming increasingly popular for investors and borrowers concerned about the environment.

Due to the risks outlined above, socially and environmentally responsible investors should review the use of funds for labeled green bonds to ensure their investment truly backs green projects.

By becoming a premium member, you can get immediate access to all the latest Moody’s credit reports for municipal bonds across the US and enhance your analysis for a specific security.