Given the rapid change in technology and access to information, it’s safe to say that U.S. consumer habits are changing at a rapid pace and the private sector is well equipped to meet and facilitate these dynamic consumer habits.

Here are some astonishing consumer figures:

- The U.S. Commerce Department reported that consumers spent over $500 billion online with U.S. merchants in 2018, which was 15% higher than the previous year

- U.S. e-commerce sales now account for almost 15% of total retail sales in the U.S. This figure was merely around 6.5% in 2012

Given the drastic changes in our consumer markets in the past decade, local and state governments have already missed out on billions of dollars in tax revenues on products sold on the internet; furthermore, local and state governments are continuing to miss out on these revenue dollars due to antiquated regulations and the lack of sales tax collection requirements for the e-commerce giants.

In this article, we will take a closer look at the collection of sales tax by local governments, how sales tax revenues flow back into our communities, the missed opportunity in collecting sales tax on e-commerce sales and how new regulations can help fill this gap.

Check out this article to know the impact of local government’s financial planning on municipal debt investors.

An Overview of Sales Tax Revenue for Local Governments

For local and state governments throughout the United States, sales tax accounts for a significant share of the total general revenues. Let’s look at four major local governments:

| Local Government | Sales Tax Revenue ($ Mn) | % of General Revenue |

|---|---|---|

Dallas, TX | 295 | 23% |

Seattle, WA | 281 | 18% |

San Francisco, CA | 291 | 7% |

Washington, DC | 1,537 | 18% |

The 45 states that impose sales tax on the purchase of goods and services are also responsible for the collection and distribution of sales tax revenues to other agencies and local government. Let’s consider Ellensburg, Washington, and review its total tax distribution. If you make $100 worth of apples in Ellensburg, WA, you will pay a total of $8.30 tax on your purchase. Of this $8.30 total, the state will retain $6.50 in its general fund, the City of Ellensburg will get $1.30 and $0.50 will be sent to other taxing districts.

It’s critical to note that almost all sales tax revenues are typically generated via purchases made in the brick-and-mortar stores in any given jurisdiction. Up until recently, the state couldn’t require a business to collect sales or use taxes on goods sold if the business didn’t have a substantial presence in the state (Supreme Court case Bellas Hess in Quill v. North Dakota) or if the business’s only contact with the customer was via remote sales sent by common carrier or mail (Supreme Court case: Bellas Hess v. Department of Revenue).

In most cases, an e-commerce company meet both requirements and the states couldn’t require them to collect sales tax on purchases made on their e-commerce channels. This resulted in huge uncollected sales tax revenues by state and local governments.

The Importance of Uncollected Sales Tax Revenues

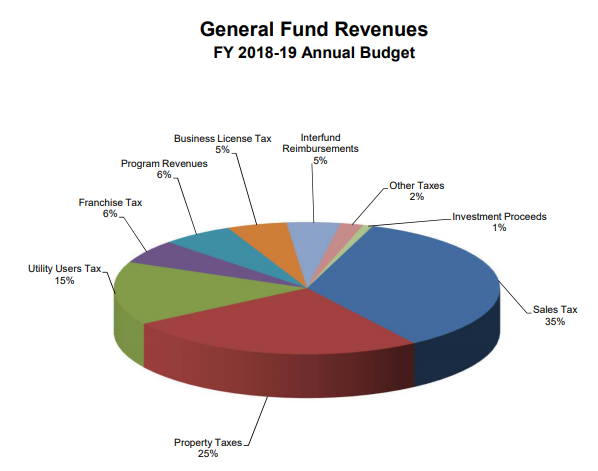

As shown in the table above, sales tax revenues play a critical role for any local or state government’s fiscal sustainability. Let’s look at Stockton, CA – a mid-size city where sales tax accounts for 35% (approximately $80 million) of total general fund revenues ($227.6 million).

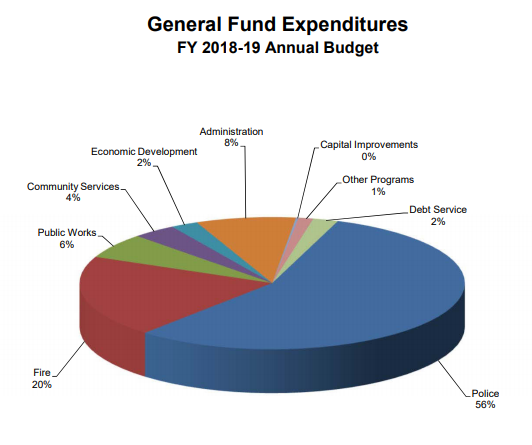

Now, when reviewing the city’s overall general fund expenditures, the city spends 76% ($167 mil) of its general fund revenues to provide police and fire service for the city’s residents. This means that if the city’s largest revenue source (i.e. sales tax) declines, it might be forced to cut some of its big-ticket expenditures like police and fire budgets.

Don’t forget to check out this article to understand the official statement for municipal debt.

How Streamlined Sales and Use Tax Agreement (SSUTA) Can Come to the Rescue

The Streamlined Sales and Use Tax Agreement was a collaborative effort of government and businesses started in March 2000 with the goal to simplify sales and use tax collection and administration. The main goal of SSUTA was also to minimize the cost and other administrative burdens on businesses that operate in multiple states – including online retailers. According to SSUTA, “the goal of this effort is to find solutions for the complexity in state sales tax systems that resulted in the U.S. Supreme Court holding (Bellas Hess v. Illinois and Quill Corp. v. North Dakota) that a state may not require a seller that does not have physical presence in the state to collect tax on sales into the state.”

In 2018, the Supreme Court ruled that the existing system was too complicated to impose on a business that did not have a physical presence in the state. The Court said that Congress has the authority to allow states to require remote sellers to collect tax. The result of this work is the SSUTA.

Under SSUTA, businesses would register for one of the two methods offered under the agreement to administer the sales tax collection, reporting and filing with each respective state where their products are being sold:

- Certified Service Provider (CSP): This option is designed to perform all the sales tax administration duties for the business: identifying the taxability on the products and services sold in any member state, calculating applicable sales tax, filing the sales tax returns and remitting the collected sales tax to the respective states. CSP software is capable of communicating with the business’s accounting system to get all the pertinent information to perform all the required tasks.

- Certified Automated System (CAS): This system will perform some of the tasks required for sales tax administrations like calculating the sales tax amounts, but it will leave all the other functions like filing and remitting of taxes to the business to perform.

A recent publication in Government Finance Officers Association (GFOA) highlighted SSUTA as a major step towards lifting the administrative burden from the business while also providing local and state governments their much-needed sales tax revenues. One example of the administrative burden for the businesses is to deal with the state and local governments on their current sales tax rates and also any changes to that rate or the law. Under SSUTA, state and local governments are required to notify sellers of any changes in the law, which substantially reduces the resources needed for a business to keep current on tax laws.

Click here to know more about the process of conducting muni bond due diligence.

The Bottom Line

Many of the U.S. local governments, like Stockton, CA, rely heavily on sales tax revenues to fund things like public safety, education and capital improvements. As more and more states are coming on board with SSUTA, it will be a major step towards fixing the inefficiencies in the sales tax administration that existed since the inception of e-commerce in the United States.

Signup for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.