In FY2022, from July 2021 to June2022, tumultuous financial markets played a key role in many pension funds registering negative investment returns. Since these pension funds invest in a wide array of investment sectors, everything from public and private equity to real estate investments, both domestic and global events adversely impacted these pension fund performances.

These pension fund performances ultimately determine the funding levels of pension obligations for all state and local governments that take part in pension funds for their employees. In addition, when pension funds calculate the pension burden for each participating agency, they use a discount rate to calculate the present value of obligations for a future pension payout. This discount value will typically be adjusted based on the investment performance of the pension fund.

In this article, we will take a closer look at how market investment returns are shaping the future of pension obligations for many local governments in the United States.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Understanding the Fiscal 2022 Pension Fund Returns

Pension obligation contributions are often the largest yearly expenditures for local and state governments relating to their employees. These contributions are made into a pension fund managed by a centralized authority that serves many other contributors. For example, California Public Employee Retirement System (CalPERS) is one of the largest pension funds for cities, counties, and other government agencies throughout California and manages more than $440 billion in assets under management.

These pension funds invest the contributed funds with an investment objective of generating returns to meet future pension payouts for their employees, who have contributed into the fund through their employers. Hence, three main components determine the future of these pension funds and how well cities and other local governments are funded for their employees’ pensions:

- Employer contributions

- Employee contributions

- Investment returns generated through the investments of pension fund assets

When one falls short, other obligations have to pick up the slack to make sure there is adequate funding for local governments.

In the case of FY2022, due to tumultuous financial conditions and other geopolitical factors, many pension funds reported negative returns on their annual reports, adding to the concerns for many employers.

The recent report, published by CalPERS, showed the fund generated a -6.1% investment return for FY22, against a rough target of 7% annual returns. However, the same pension fund achieved over 21% in investment returns in the prior fiscal year. The recent report on FY22 stated, “Tumultuous global markets played a role in CalPERS’ first loss since the global financial crisis of 2009, as the System today announced a preliminary -6.1% net return on investments for the 12-month period that ended June 30, 2022.” Assets stood at $440 billion at the end of the fiscal year.

“We’ve done a lot of work in recent years to plan and prepare for difficult conditions,” said CalPERS Chief Executive Officer Marcie Frost. “Despite the market conditions and their impact on our returns, we’re focused on long-term performance and our members can be confident that their retirement is safe and secure.”

Volatile global financial markets, geopolitical instability, domestic interest rate hikes, and inflation all had an impact on public market returns. It’s crucial to note that a 6% negative return against a roughly 7% investment return expectation equates to a 13% loss that’s below the fund’s expectation.

Don’t forget to check our Muni Bond Screener.

Diversification of Pension Funds

Unlike the investment of public funds for local governments—which is bound to invest in strict fixed income portfolios—pension funds are typically allowed to invest in larger investment sectors, including public and private equities, real estate, fixed income, and other investment vehicles. The most recent investment report for CalPERS shows that the fund was invested in the following sectors and maintained these investment asset classes over the years:

- Public Equity: 47%

- Private Equity: 10.9%

- Fixed Income: 27.6%

- Real Estate: 13%

- Total Fund: 3.1%

- Financing & Liquidity: -1.6%

Source: California Public Employees Retirement System

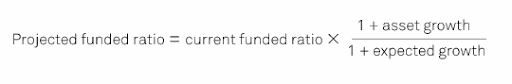

With the FY2022 market uncertainty, the fund returned -13% on public equities and -14.5% on fixed income, while generating strong returns on private equity (21.3%) and real estate (24.1%). As aforementioned, these negative returns will impact the funding ratios for many cities and counties and add to their unfunded liabilities. The pension funded ratio is typically calculated using the following formula:

The Bottom Line

Market uncertainty is inevitable, and these pension fund returns will continue to play a role in a local government’s pension funding calculations. However, to stabilize pension costs, many local governments are setting aside funds to meet future unfunded pension obligations and/or mitigate the risk of future sustained economic downturns that can have a severe impact on pension funds. Investors should carefully consider the local government’s pension obligations to assess the full financial sustainability.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.